Small Parcel Post-Lockdown: Are your shipping rates (still) competitive?

Here’s how to find out and what to do if they’re not.

The last several months have seen significant changes take place in the U.S. shipping landscape, particularly in small parcel. So what does small parcel post-lockdown look like? And more importantly, what does it look like for you? And what can you do about it?

The most obvious change has been the explosive surge in ecommerce sales. Mastercard reported in June that ecommerce spending in April & May topped the last 12 Cyber Mondays combined. Online U.S. sales in those months made up 22% of all retail sales, double the rate in the same period last year.

That surge has abated as physical stores and restaurants have been allowed to reopen, but many small parcel shippers are wondering if some of the changes in their shipping patterns might be more permanent. And if so, how do they make sure they’re still getting the best rates from the carriers?

This was a topic of discussion on a recent episode of Transportation Impact’s Let’s Talk Ship webinar series.

During the episode, guests Brian Byrd, Transportation Impact’s VP of Operations, and Gary Dachs, TI Director of Pricing, drew on analysis of data from hundreds of TI clients to provide useful advice in response to the question of how shippers can understand if their small parcel rates are still competitive, and what to do about it.

You can access the full webinar recording here: Let’s Talk Ship: How to Understand if Your Freight & Small Parcel Rates Are Competitive & What to Do if They Are Not.

Here is some of Brian’s and Gary’s advice.

Small Parcel Post-Lockdown: 4 steps to make sure you’re still getting competitive rates

The first step is to understand your own shipping characteristics by analyzing your data. For this it’s important to make sure you’re using quality data.

1. Code your data and compare the two sets: pre-lockdown and post-lockdown.

2. Analyze what has changed by looking at package characteristics, usage and service modes, origin-destination pairs, and other relevant metrics.

You might notice some or all of the following changes:

- A shift from brick & mortar B2B to omnichannel B2C.

- Where you previously would ship premium/expedited, you’re now shipping ground or a postal hybrid.

- A change in the number of bulky shipments: more or fewer.

- You’re now shipping at higher average weights or DIMs.

3. Compare the new shipping patterns to the negotiated areas of your carrier agreement(s) to analyze your cost exposure.

For example, if you’re now shipping higher weights or more bulky packages, renegotiate to reduce related surcharges. Likewise if you’ve seen a significant shift from commercial to residential, or vice versa.

4. Understand the constraints and challenges the carriers are facing.

For example, FedEx domestic made up 56% of total volume this time last year; as of last quarter, it was 72%. This puts pressure on the carrier because its delivery model is optimized for commercial.

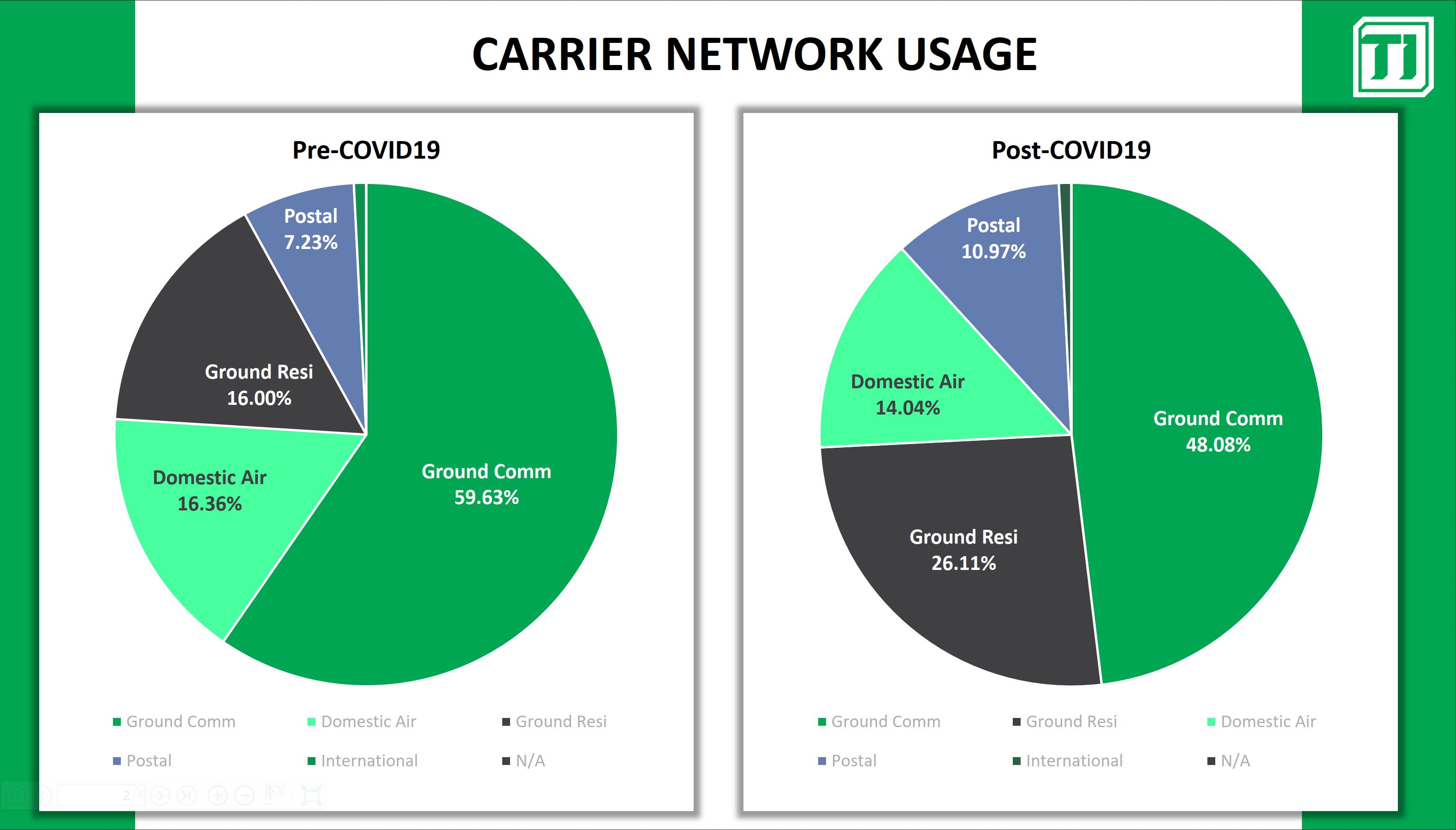

This change also holds across the board. Analysis of tens of thousands of data points from TI customers revealed the following notable shifts (this slide and other insights are presented in the webinar).

Understanding the carriers’ challenges will help you be educated before you go to renegotiate your agreement to meet your new needs and challenges, and give you a greater chance of getting the optimal agreement for your new shipping landscape.

If you’d like to get regular insights of this type, join our Let’s Talk Ship webinar series, which takes place the second Thursday of each month. Register and access the recordings of previous episodes here: https://transportationimpact.com/lets-talk-ship/

If you’d like help in analyzing your data or renegotiating your carrier agreement, give us a call at (252) 764-2885 or shoot us an email at info@transimpact.com.

Posts by Tag

- October 2018 (8)

- August 2018 (6)

- August 2019 (6)

- February 2020 (6)

- March 2020 (6)

- May 2020 (6)

- December 2020 (6)

- April 2019 (5)

- May 2019 (5)

- July 2019 (5)

- October 2019 (5)

- April 2020 (5)

- July 2020 (5)

- September 2020 (5)

- October 2020 (5)

- July 2018 (4)

- September 2018 (4)

- January 2019 (4)

- February 2019 (4)

- March 2019 (4)

- June 2019 (4)

- September 2019 (4)

- December 2019 (4)

- January 2020 (4)

- June 2020 (4)

- August 2020 (4)

- April 2018 (3)

- June 2018 (3)

- November 2018 (3)

- December 2018 (3)

- November 2020 (3)

- January 2021 (3)

- March 2018 (2)

- November 2019 (2)

- February 2021 (1)

- May 2021 (1)

8921 Crew Drive

Emerald Isle, NC 28594

(252) 764-2885

info@transimpact.com

Get In Touch!

FedEx Announces SmartPost GRI for 2021

2020 Holiday Shipping Deadlines Are Here!

FedEx Announces SmartPost GRI for 2021

2020 Holiday Shipping Deadlines Are Here!